Underwriting Solutions

Addressing Underwriting Problems With Solutions

Rather than providing generic weather data, we offer underwriting solutions to reduce the issues below.

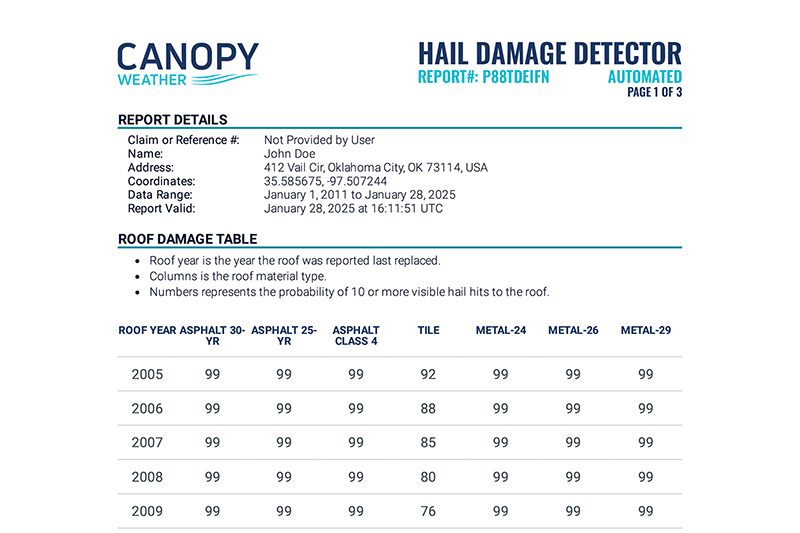

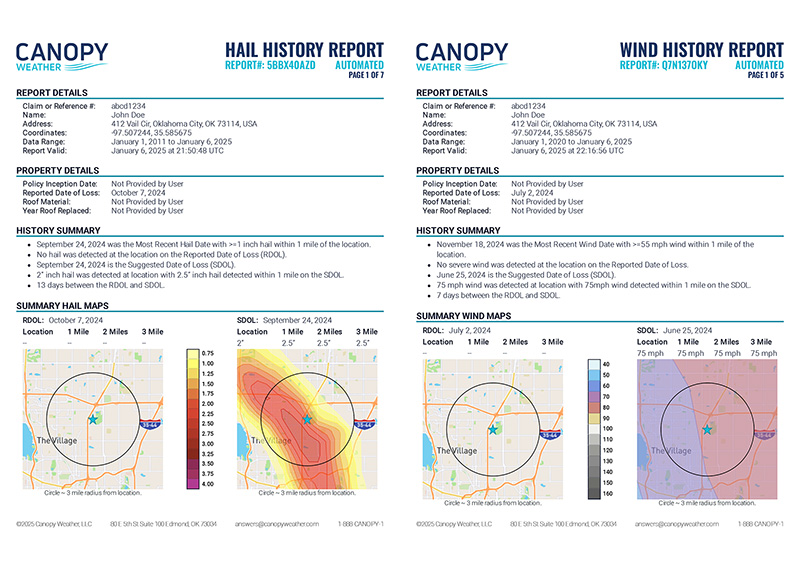

PROBLEM: Underwriting Bad Hail Risks

SOLUTION:

Use Hail DamageDetectorTM to flag properties likely to have pre-existing hail damage at the time of quote. When paired with Hail History Reports, DamageDetectorTM can help underwriters assess the severity of prior storm events to avoid taking on new policies likely to file a hail claim in the near future. Carriers can then decline to provide coverage, write ACV instead of RCV, require a roof exclusion, or require roof replacement.

Useful Products For Underwriting:

Book a Discovery Call

Ready to see how our solutions can transform your workflows? Book a discovery call today to learn more about how we can support your business.

Triangulation: The Key to Clarity

We believe that the clearest answers come from examining multiple perspectives. That’s why our approach is grounded in the principle of triangulation: combining diverse data sources, expert analysis, and cutting-edge technology to arrive at clear, practical solutions. With triangulation as our foundation, we’re able to provide the actionable insights our clients need to navigate the complexities of weather impacts confidently.