Empower Your Decisions with Accurate Storm Data, Faster Claims Resolution, and Reduced Costs

Canopy Weather delivers forensic-level hail, wind, and tornado data, driving confident decision-making across insurance, restoration, and government.

Trusted Roof Peril Solutions for P&C Claims & Underwriting

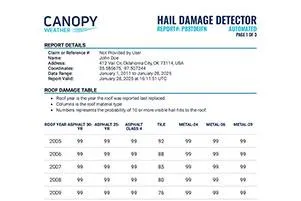

Hail Date of Loss Verification

Hail Damage Detector™ Scores

Hail Impact Prediction

Optimize Your Claims Workflow

Ready for faster settlements and fewer disputes? Book a personalized consultation to learn how our triangulation approach improves the accuracy of your entire claims process.

70% of global insured losses were driven by severe convective storms (SCS) in recent years. In the U.S., SCS caused $38 billion of insured loss in the first half of 2023, breaking the record of $33 billion set in the first half of 2011. From 1990 to 2022, SCS insured losses increased at an annual rate of 8.9 percent.

Aon Insights, 2023

The Growing Impact of Severe Convective Storms on property LOsses

Severe convective storms (SCS), including tornadoes, hailstorms, and damaging winds, cause significant damage annually in the US. In 2024 alone, the United States experienced two major hurricanes and a particularly high frequency of severe thunderstorms, accounting for at least two-thirds of the year’s global insured losses. By early December 2024 estimates, global insured losses exceeded USD 135 billion, with the U.S. share reaching around $90 billion.

In recent years, SCS insured losses have been rising, with an annual rate of 8.9% growth from 1990 to 2022.

The rising insured losses from SCS perils highlight the urgent need for precise and actionable data solutions. As losses continue to climb, insurers, reinsurers, and government agencies are turning to forensic storm mapping and analytics to reduce unnecessary payouts and strengthen their response strategies. Proactive engagement with policyholders, supported by real-time weather data, enables insurers to combat inflated or fraudulent claims effectively.

In this high-loss environment, Canopy Weather’s specialized expertise in hail, wind, and tornado data provides a competitive advantage, helping our clients navigate increasingly complex weather challenges.

Who We Serve

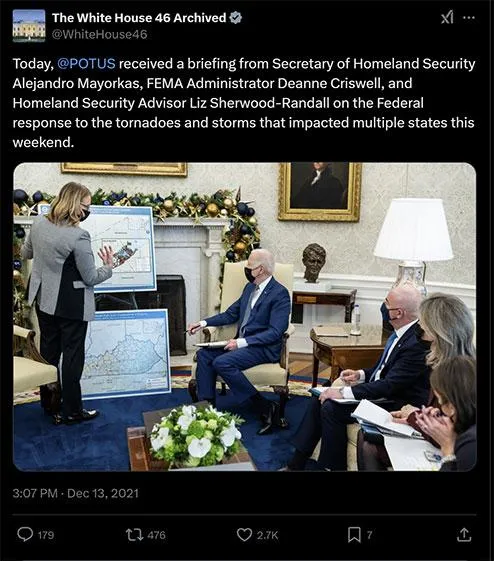

While we primarily serve the insurance industry, working with market-leading primary insurance carriers (especially claims and underwriting), reinsurers, reinsurance brokers, and MGA/MGUs, our data also supports governmental disaster response efforts. FEMA uses our weather peril data to trim days—even weeks—off effective tornado responses. Additionally, through partnerships with our sister company HailTrace, our impact extends to storm restoration.

Why Canopy?

We exclusively focus on the perils that affect the roof (wind, hail, tornado) to better serve our claims and underwriting clients – we don’t get distracted by floods, health claims, car claims, etc. Our clients understand that the cost of bad data is exponentially more expensive than relying on multiple vendors – especially when each vendor is an expert focused on their data specialty.

-

Actual vs. Hypothetical

We focus on what ACTUALLY happened, not what could have potentially occurred

-

Human-in-the-Loop

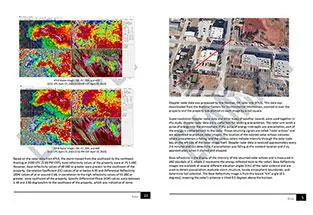

Human specialists refine algorithmic results based on decades of experience

-

Multi-Source Triangulation

We aggregate multiple data sources for best approximation of reality

-

Actual vs. Hypothetical

We focus on what ACTUALLY happened, not what could have potentially occurred

-

Human-in-the-Loop

Human specialists refine algorithmic results based on decades of experience

-

Multi-Source Triangulation

We aggregate multiple data sources for best approximation of reality

Streamline Underwriting Decisions

Give your underwriters the precise data they need. Schedule a demo to discover how our accurate storm intelligence can lower risk and boost profitability.

Our Values

-

INSPIRE

by transforming the world through applied geoscience and intelligence

-

INVENT

by creating pre-eminent weather and climate applications

-

INNOVATE

by consistently redefining best practices

-

INSPIRE

by transforming the world through applied geoscience and intelligence

-

INVENT

by creating pre-eminent weather and climate applications

-

INNOVATE

by consistently redefining best practices